The 179D commercial buildings energy efficiency tax deduction primarily enables building owners to claim a tax deduction for installing qualifying systems and buildings. Tenants may be eligible if they make construction expenditures. If the system or building is installed on federal, state, or local government property, the 179D tax deduction may be taken by the person primarily responsible for the system’s design. The systems and buildings must have been placed in service by December 31, 2016, which is when 179D expires. Deductions are taken in the year in which systems and buildings are placed in service. The 179D tax deduction has been in effect since January 1, 2006.

A tax deduction of $1.80 per square foot is available to owners of new or existing buildings who install (1) interior lighting; (2) building envelope, or (3) heating, cooling, ventilation, or hot water systems that reduce the building’s total energy and power cost by 50% or more in comparison to a building meeting minimum requirements set by ASHRAE Standard 90.1-2001 (for buildings and systems placed in service before January 1, 2016) or 90.1-2007 (for buildings and systems placed in service before January 1, 2017). Energy savings must be calculated using qualified computer software, which we link to below.

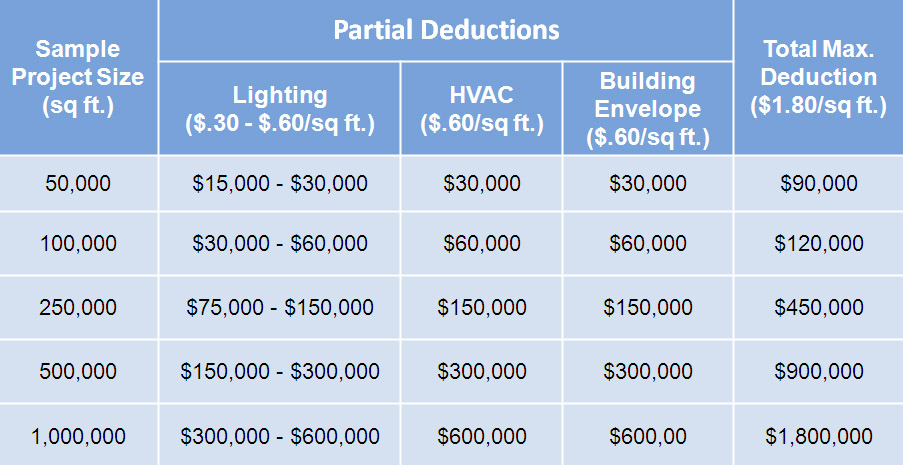

Deductions of $0.60 per square foot are available to owners of buildings in which individual lighting, building envelope, or heating and cooling systems that partially qualify be meeting certain target levels or through the interim lighting rule. These three compliance pathways are shown in the table below.

Summary of 179D Tax Deductions |

||||||

| Fully Qualifying Property | Partially Qualifying Property | Interim Lighting Rule | ||||

| IRS Notice (Effective Dates) | Envelope | HVAC and HW | Lighting | |||

| Savings Requirements* | 50% | 2006-52 (1/1/06 – 12/31/08) |

16 2/3% | 16 2/3% | 16 2/3% | 25%-40% lower lighting power density (50% for warehouses) |

| 2008-40 (1/1/06 – 12/31/13) |

10% | 20% | 20% | |||

| 2012-26 (3/12/12 – 12/31/16) |

10% | 15% | 25% | |||

| Tax Deduction (not to exceed cost of qualifying property) | $1.80/ft² | $0.60/ft² | $0.60/ft² | $0.60/ft² | $0.60/ft² times applicable percentage** | |

* Savings refer to the reduction in the energy and power costs of the combined energy for the interior lighting, HVAC, and HW systems as compared to a reference building that meets the minimum requirements of ASHRAE Standard 90.1-2001 for buildings placed in service prior to 1/1/2016 and ASHRAE Standard 90.1-2007 for buildings placed in service on or after 1/1/2016.

** The tax deduction is prorated depending on the reduction in LPD. See IRS Notice 2006-52 for the definition of “applicable percentage.”